Ministry of Finance

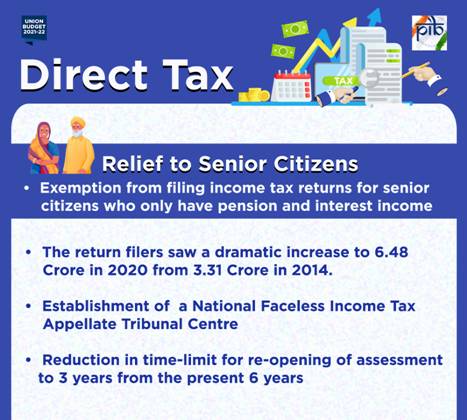

Senior Citizens above 75 years of Age, Having Pension & Interest Income exempted from Filing Tax Return

Further push to Affordable / Rental housing

Faceless dispute resolution committee in the offing

Tax relaxations for attracting Foreign Investment in Infrastructure sector

Tax incentives announced in Budget for Start-ups

Number of return fillers increased from 3.31 Crore to 6.48 Crore in 6 years

The Union Budget 2021-22 presented in Parliament today by the Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman seeks to further simplify the Tax Administration, Litigation Management and ease the compliance of Direct Tax Administration.

In the Budget Speech, the Finance Minister provided relief to senior citizens in filing of income tax returns, reduced time limit for income tax proceedings, announced setting up of the Dispute Resolution Committee, faceless ITAT, relaxation to NRIs, increase in exemption limit from audit and relief for dividend income. She also announced steps to attract foreign investment into infrastructure, relief to affordable housing and rental housing, tax incentives to IFSC, relief to small charitable trusts, and steps for incentivizing Start-ups in the country.

Smt.Nirmala Sitharaman, in her Budget speech, said that post-pandemic, a new world order seems to be emerging and India will have a leading role therein. She said in this scenario, our tax system has to be transparent, efficient and should promote investment and employment in the country. The Minister said that at the same time, it should put minimum burden on our tax payers. She said that a series of reforms had been introduced by the Government for the benefit of tax payers and economy, including slashing of corporate tax rate, abolition of dividend distribution tax, and increasing of rebate for small tax payers. In the year 2020, the income tax return filers saw a dramatic increase to 6.48 crore from 3.31 crore in 2014.

RELIEF TO SENIOR CITIZENS

In the 75th year of independence, the Budget seeks to reduce compliance burden on senior citizens who are of 75 years of age and above. Such senior citizens having only pension and interest income, will be exempted from filing their income tax return. The paying Bank will deduct the necessary tax on their income.

RELAXATION TO NRIs, RELIEF FOR DIVIDEND

The Budget proposes to notify rules for removing the hardship of Non-Resident Indians returning to India, on the issue of their accrued incomes in their foreign retirement account. It proposes to make dividend payment to REIT/InvIT exempt from TDS. For Foreign Portfolio Investors, the Budget proposes deduction of tax on dividend income at lower treaty rate. The Budget provides that advanced tax liability on dividend income shall arise only after the declaration or payment of dividend. The Minister said that this was being done as the amount of dividend income cannot be estimated correctly by the shareholders for paying advance tax.

AFFORDABLE HOUSING/ RENTAL HOUSING

The Finance Minister proposed to extend the eligibility period for claim of additional deduction for interest of Rs. 1.5 lakh on loan taken for purchase of an affordable house to 31st March, 2022. In order to increase the supply of affordable houses, she also announced extension of eligibility period for claiming tax holiday for affordable housing projects by one more year to 31st March, 2022. For promoting supply of affordable rental housing for the migrant workers, the Minister announced a new tax exemption for the notified affordable rental housing projects.

TAX BENEFITS FOR START UPS

In order to incentivize start ups in the country, Smt. Sitharaman announced extension in the eligibility for claiming tax holiday for startups by one more year till 31st March, 2022. In order to incentivize funding of start ups, she proposed extending the Capital Gains exemption for investment in start ups by one more year till 31st March, 2022.

TIMELY DEPOSIT OF EMPLOYEES’ CONTRIBUTION TO LABOUR WELFARE FUNDS

The Finance Minister said that delay in deposit of the contribution of employees towards various welfare funds results in permanent loss of interest/income for the employees. In order to ensure timely deposit of employee’s contribution to these funds by the employers, she announced that late deposit of employee’s contribution shall never be allowed as deduction to the employer.

REDUCTION IN TIME FOR REOPENING INCOME TAX PROCEEDINGS

In order to reduce compliance burden, the Budget provides reduction in the time-limit for reopening of income tax proceedings to three years from the present six years. In serious tax evasion cases, where there is evidence of concealment of income of Rs. 50 lakh or more in a year, the assessment can be reopened upto 10 years but only after the approval of the Principal Chief Commissioner.

DISPUTE RESOLUTION COMMITTEE & NATIONAL FACELESS INCOME TAX APPELLATE TRIBUNAL CENTRE

Stating the resolve of the Government to reduce litigation in the taxation system, the Finance Minister said that the Direct Tax ‘Vivad se Vishwas’ Scheme announced by the Government has been received well. Until 30th January, 2021, over one lakh ten thousand tax payers have opted to settle tax dispute of over Rs. 85 thousand crores under the Scheme. To further reduce litigation of small tax payers, Smt. Sitharaman proposed to constitute a Dispute Resolution Committee. Anyone with a taxable income upto Rs. 50 lakh and disputed income upto Rs. 10 lakh, shall be eligible to approach the Committee which will be faceless to ensure efficiency, transparency and accountability. She also announced setting up of National Faceless Income Tax Appellate Tribunal Centre.

TAX AUDIT LIMIT HIKED FOR DIGITAL TRANSACTIONS

To incentivize digital transactions and to reduce the compliance burden of the person who is carrying almost all of their transactions digitally, the Budget proposes to increase the limit for tax audit for persons who are undertaking 95 per cent of their transaction digitally from Rs. 5 Crore to Rs. 10 Crore.

INCENTIVES FOR FOREIGN INVESTMENTS

To attract foreign investment into infrastructure sector, the Budget proposes to relax certain conditions relating to prohibition on private funding, restriction on commercial activities and direct investment in infrastructure. In order to allow funding of infrastructure by issue of zero coupon bonds, the Budget proposes to make notified infrastructure debt funds eligible to raise funds by issuing tax efficient zero coupon bonds.

TAX INCENTIVE TO IFSC

In order to promote International Financial Services Centre (IFSC) in GIFT City, the Budget proposes more tax incentives which include tax holiday for Capital gains from incomes of aircraft leasing companies, tax exemption for aircraft lease rentals paid to foreign lessors, tax incentives for relocating foreign funds in the IFSC and to allow tax exemption to the investment division of foreign banks located in IFSC.

RELIEF TO SMALL TRUSTS

In order to reduce compliance burden on the small charitable trusts running educational institutions and hospitals, the Budget proposes to increase the limit on annual receipts for these trusts from present Rs.1 Crore to Rs. 5 Crore for non-applicability of various compliances.

FACELESS ITAT

Smt. Nirmala Sitharaman further proposed to make Income Tax Appellate Tribunal faceless. She proposed a National Faceless Income Appellate Tribunal Centre, wherein all communication between the Tribunal and the appellant shall be electronic.

PRE-FILLING OF RETURNS

In order to ease filing of returns, the Budget proposes that details of capital gains from listed securities, dividend income and interest from banks, post office etc. will also be pre-filled in returns. Details of salary income, tax payment, TDS etc already come pre-filled in returns.

******

No comments:

Post a Comment