Friday, 30 October 2020

Confederation Press Statement Dated 28.10.2020

PRESS STATEMENT.

Dated: 28.10.2020

Confederation of Central Government Employees and workers notes with distress that the Government has made yet another attempt to depress the wages of the workers this time in the organised sector. The indexation of wages and the consequent grant of compensatory allowance had been the product of bitter and prolonged struggles of the workers. The present system of computing the dearness compensation, though varies from sector to sector, is based on the consumer price index brought out in stipulated periodicity by the Ministry of Labour. There had been varied and wide ranging criticism over the manner and methodology adopted in the computation of the index figures. Instead of addressing those genuine and legitimate deficiencies, the Government has gone now to create a new series which would further accentuate those very defects to the utter disadvantage of the workers. It is all the more deplorable as the Government has chosen the pandemic days to usher in the new series of CPI.

The Government will bring out the new series with 2016 as the base year. 2016, in so far as Indian economy is concerned, is an extremely extra ordinary year when the economic activities almost came to a grinding halt over the grand declaration of demonetisation. It is an established dictum that base year selected must be a normal year, sans political, social and economic upheaval. Why then 2016, has no logical explanation.

The Government has also decided to change the components of the basket. Post justification had been an afterthought, conceived to cover up. Had there been a consultation with the stake holders, many of the controversies that have arisen could have been avoided. By depressing the food content in the basket, the lower rung in the working class will lose out more. In the past, the base year change used to be effected once after two decades. Why then the periodicity was reduced and bring out a new series now begs reasoned explanation.

Another important decision that would further depress the dearness compensation to the workers is that the Government has chosen the PDS prices of the commodities for computation. Universal PDS was disbanded when the new liberal economic policies were ushered in years back. The present truncated PDS targets only a segment of the population and most of the Central Government employees are excluded from the PDS in almost all States in the country. This apart the prices of the commodities sold in the PDS is highly subsided. Consequently, the prices of commodities included in the basket are nothing but imaginary and often below even the cost of production of such items. Since dearness compensation as an accretion to wages is available for the workers in the organised sector, the new series will bring about drastically reduced salary packet. The Centrals Government employees especially will lose out heavily once the new series are put in operation, which is announced to be with effect from September, 2016 onwards.

On the advice of the Technical Advisory committee, the geometrical mean will be employed instead of the arithmetical average . The conversion factor of 2.88 is devised possibly without taking this factor into account. The conversion factor will be employed in the case of Central Government employees for a very long time to come from September, 2020 onwards. The ruling class was always opposed to the grant of dearness compensation, rather the very concept itself. In the long run, they want the wages to remain static and the prices dynamic to ensure that the Corporates are happy. The resentment against this arbitrary, unilateral and anti-employees decision must be manifested by the increased participation of the Central Government employees in the ensuing one day general strike slated for 26th November,2020, which is organised by the Central Trade Unions on behalf of the Indian working class.

R.N. PARASHAR

SECRETARY GENERAL.

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees

Ministry of Finance

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees

In view of the COVID-19 pandemic and resultant nationwide lockdown as well as disruption of transport and hospitality sector, as also the need for observing social distancing, a number of employees are not able to avail of Leave Travel Concession (LTC) in the current Block of 2018-21.

With a view to compensate Central Government employees and incentivise consumption, thereby giving a boost to consumption expenditure, the Government of India allowed payment of cash allowance equivalent to LTC fare to Central Government employees subject to fulfilment of certain conditions vide OM No F. No 12(2)/2020-EII (A) dated 12th October 2020. It has also been provided that since the cash allowance of LTC fare is in lieu of deemed actual travel, the same shall be eligible for income-tax exemption on the lines of existing income-tax exemption available for LTC fare.

In order to provide the benefits to other employees (i.e. non-Central Government employees) who are not covered by the above mentioned OM, it has been decided to provide similar income-tax exemption for the payment of cash equivalent of LTC fare to the non-Central Government employees also. Accordingly, the payment of cash allowance, subject to maximum of Rs 36,000 per person as Deemed LTC fare per person (Round Trip) to non-Central Government employees, shall be allowed income-tax exemption subject to fulfilment of conditions specified in para 4.

The income-tax exemption to receipt of deemed LTC fare by a non-Central Government employee (‘the employee’) shall be allowed subject to fulfilment of the following conditions:-

(a) The employee exercises an option for the deemed LTC fare in lieu of the applicable LTC in the Block year 2018-21.

(b) The employee spends a sum equals to three times of the value of the deemed LTC fare on purchase of goods / services which carry a GST rate of not less than 12% from GST registered vendors / service providers (‘the specified expenditure’) through digital mode during the period from the 12th of October, 2020 to 31st of March, 2021 (‘specified period’) and obtains a voucher indicating the GST number and the amount of GST paid.

(c) An employee who spends less than three times of the deemed LTC fare on specified expenditure during the specified period shall not be entitled to receive full amount of deemed LTC fare and the related income-tax exemption and the amount of both shall be reduced proportionately as explained in Example-A below.

The DDOs shall allow income-tax exemption subject to fulfilment of the above conditions after obtaining copies of invoices of specified expenditure incurred during the specified period. Further, as this exemption is in lieu of the exemption provided for LTC fare, an employee who has exercised an option to pay income tax under concessional tax regime under section 115BAC of the Income-tax Act, 1961 shall not be entitled for this exemption.

The clarifications issued by the Department of Expenditure, Ministry of Finance for the Central Government employees vide OM F. No 12(2)/2020-EII (A) Dated 20th October, 2020 and subsequent clarification, if any, issued in this regard shall apply mutatis mutandis to non-Central Government employees also subject to fulfilment of conditions specified in the preceding paras.

The legislative amendment to the provisions of the Income-tax Act, 1961 for this purpose shall be proposed in due course.

Example-A

Deemed LTC Fare : Rs.20,000 x 4 = Rs. 80,000

Amount to be spent : Rs. 80,000 x 3 = Rs. 2,40,000

Thus, if an employee spends Rs. 2,40,000 or above on specified expenditure, he shall be entitled for full deemed LTC fare and the related income-tax exemption. However, if the employee spends Rs. 1,80,000 only, then he shall be entitled for 75% (i.e. Rs. 60,000) of deemed LTC fare and the related income-tax exemption. In case the employee already received Rs. 80,000 from employer in advance, he has to refund Rs. 20,000 to the employer as he could spend only 75% of the required amount.

****

Thursday, 29 October 2020

Wednesday, 28 October 2020

Tuesday, 27 October 2020

India Post and United States Postal Service (USPS) signs Agreement for Electronic Exchange of Customs Datarelated to postal shipments exchanged between the two countries

Ministry of Communications

India Post and United States Postal Service (USPS) signs Agreement for Electronic Exchange of Customs Datarelated to postal shipments exchanged between the two countries

The agreement aims to facilitate ‘ease of exports’ for small and large exporters through postal channels

Department of Posts, Government of India (India Post) and United States Postal Service (USPS) have entered into an agreement for Electronic Exchange of Customs data related to postal shipments exchanged between the two countries. The agreement will make it possible to transmit and receive electronic data of international postal items prior to their physical arrival at the destination and would enable customs clearance of postal items in advance in line with the evolving global postal framework. This will also improve the performance of postal services in terms of reliability, visibility and security.

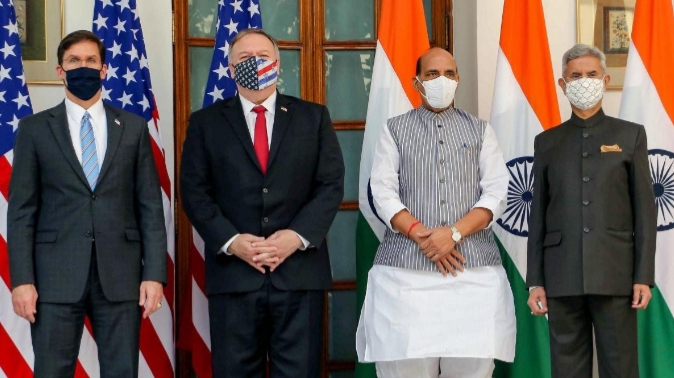

Photo Source: PTI

USA is the top export destination for India (~17%) which is also reflected in exchange of goods through postal channel. In 2019, around 20% of outbound EMS and 30% of Letters & Small Packets transmitted by India Post were destined to USA whereas 60% of the Parcels received by India Post were originated from USA. Exchange of Electronic Advance Data (EAD) as per the Agreement will be a key driver towards promoting mutual trade with emphasis on the exports from different parts of India to USA through postal channel considering that USA is a major destination of MSME products, Gems &Jewelry, Pharmaceuticals and other local products from India. This will fulfill a major demand of export industry to expedite customs clearances of export items.

The primary objective that will be served by this agreement is to facilitate ‘ease of exports’ for small and large exporters through postal channels from different parts of the country and will contribute towards making India an Export Hub for the world.

The agreement was signed by Mr. Prannoy Sharma, Deputy Director General (International Relations & Global Business), Department of Posts, Government of India and Mr. Robert H. Raines Jr., Managing Director, Global Business of United States Postal Service.

Monday, 26 October 2020

DoPT reforms regarding Child Care Leave

Ministry of Personnel, Public Grievances & Pensions

DoPT reforms regarding Child Care Leave

While briefing about some of the major reforms brought by Department of Personnel & Training (DoPT) under the Modi government, Union Minister of State (Independent Charge) Development of North Eastern Region (DoNER), MoS PMO, Personnel, Public Grievances, Pensions, Atomic Energy and Space, Dr Jitendra Singh said today that the male employees of the government are also now entitled to Child Care Leave.

However, Dr Jitendra Singh said that the provision and privilege of Child Care Leave (CCL) will be available only for those male employees who happen to be “single male parent”, which may include male employees who are widowers or divorcees or even unmarried and may therefore, be expected to take up the responsibility of child care as a single - handed parent.

Describing it as a path-breaking and progressive reform to bring ease of living for government servants, Dr Jitendra Singh said, the orders regarding this had been issued quite some time back but somehow did not receive enough circulation in the public.

In a further relaxation to this provision, Dr Jitendra Singh informed that an employee on Child Care Leave may now leave the head quarter with the prior approval of Competent Authority. In addition, the Leave Travel Concession (LTC) may be availed by the employee even if he is on Child Care Leave. Elaborating further, he informed that Child Care Leave can be granted at 100% of leave salary for the first 365 days and 80% of leave salary for the next 365 days.

Based on the inputs over a period of time, Dr Jitendra Singh said, another welfare measure introduced in this regard is that in case of a disabled child, the condition of availing Child Care Leave up to the age of 22 years of the child has been removed and now Child Care Leave can be availed by a government servant for a disabled child of any age.

With the personal intervention and indulgence of Prime Minister Sh Narendra Modi and his special emphasis on governance reforms, Dr Jitendra Singh said, it has been possible to make several out-of-box decisions in the DoPT over the last six years. Basic purpose behind all these decisions has always been to enable a government employee to contribute to the maximum of his potential, although at the same time there will be no leniency or tolerance toward corruption or non-performance, he said.

Sunday, 25 October 2020

Saturday, 24 October 2020

REVISED DRAFT STRIKE NOTICE TO BE SERVED ON 27.10.2020 (Issued by NFPE afresh)

No.PF-12-C/2020 Dated: 27th October—2020

To

The Secretary / Director General,

Department of Posts,

Dak Bhawan,

New Delhi – 110001

NOTICE

Sir,

In accordance with the provisions of Sub Section (1) of section 22 of the Industrial Disputes Act, 1947, we hereby notify that all Postal, RMS & GDS Employees will go on One Day Strike on 26th November-2020.

The Charter of Demands is enclosed herewith

Yours Sincerely

CHARTER OF DEMANDS PART-A

1. Scrap New Contributory Pension Scheme (NPS). Restore old defined benefit Pension Scheme (OPS) to all employees. Guarantee 50% of the last pay drawn as minimum pension.

2. (a) Scrap the draconian FR 56((j) & (i) and Rule 48 of CCS (Pension) Rules 1972. Stop terrorizing and victimising employees.

(b) Withdraw the attack against the recognised status of Associations and Federations.

(c) Withdraw the anti-worker Wage/Labour codes and other anti-labour reforms.

(d) Stop attack on trade union rights.

3. (a) Withdraw the orders freezing the DA and DR of employees and Pensioners and impounding of arrears till 30-06-2021.

(b) Implement five year wage revision and Pension revision to Central Government employees and Pensioners. Appoint 8th Central Pay Commission and revise the Pay, Allowances and Pensionary benefits of Central Government employees and Pensioners with effect from 01-01-2021.

(c) Honour the assurance given by Group of Ministers (GoM) to NJCA leaders on 30-06-2016. Increase minimum pay and fitment formula recommended by 7th CPC. Grant HRA arrears from 01-01-2016.

(d) Withdraw “Very Good” bench mark for MACP, grant promotional heirarchy and date of effect of MACP from 01-01-2006.

(e) Grant Option-1 parity recommended by 7th CPC to all Central Govt. Pensioners. Grant one notional increment to those who retired on 30th June.

(f) Settle all anomalies arising out of 7th CPC implementation.

4. Stop ban on creation of new posts. Fill up all seven lakhs vacant posts in Central Government departments in a time bound manner. Scrap National Recruitment Agency and introduce Departmentwise recruitment and Regional recruitment for Group B and C posts. Stop re-engaging retired personnel in Central Govt. services.

5. Stop Corporatisation and privatisation of Railways, Defence and Postal Departments. Withdraw closure/merger orders of Govt. of India Printing Presses and Postal Stores depots/Postal Stamp depots. Stop proposed move to close down salt department. Stop outsourcing and closure of Govt. establishments.s

6. (a) Regularisation of Gramin Dak Sevaks and grant of Civil Servants status. Implement remaining positive recommendations of Kamalesh Chandra Committee Report.

(b) Regularise all casual and contract workers including those joined service on or after 01-09-1993.

7. Settle all Covid-9 related issues pertaining to Central Govt. employees and Pensioners on top priority basis. Treat the period of absence during lock down as duty. Grant full wages to casual, part-time, contingent and contract workers during the lock down period.

8. Grant equal pay for equal work for all. Remove disparity in pay scales between Central Secretariat staff and similarly placed staff working in field units of various departments.

9. Implement 7th CPC wage revision and pension revision to remaining Autonomous body employees and pensioners. Ensure payment of full arrears without further delay. Grant Bonus to Autonomous body employees pending from 2016-17 onwards

10. Remove arbitrary 5% ceiling imposed on compassionate appointments. Grant appointment in all eligible cases.

11. Grant five time-bound promotions to all Group B & C employees. Complete cadre review in all departments in a time bound manner.

12. Ensure prompt functioning of various negotiating forums under the JCM Scheme at all levels.

CHARTER OF DEMANDS PART-B

1. (a) Grant of Special Casual Leave to all the employees who could not attend due to Covid-19 related problems and issue of Uniform Guide Lines

(b) Grant of Compensation of Rs. 10 Lakh to the family of deceased due to Covid-19 without any further delay.

(c) Compassionate appointment to one ward of the deceased employee due to Covid-19.

(d) Payment of wages to Casual/Part-time /Contingent /DRM & Out sourced Workers for the Lockdown period.

(e) Continuance of Roaster till Covid-19 Problem persists.

2. Stop Closure / Merger of PSDs/ CSDs/Post Offices/RMS Offices and Mail Motor Services. Stop Road Transport Network proposal.

3. Drop the idea of Decentralization of Postal Accounts offices and merger of Circle office and SBCO Cadre in PA Cadre.

4. Stop harassment and allotment of unscientific targets to open IPPB accounts and Aadhar Enabled Payment Service and Aadhar Card Service.

5. Stop Proposal of Common Service Centres in POs.

6. Fill up all vacant posts in all Cadres and stop Recruitment of Outsourced Postal Agents particularly to run the Parcel Hubs in Department of Posts.

7. Start Membership Verification for Regular and GDS Employees through Old Check-Off System, droop the idea of Online Verification.

8. Implement remaining positive recommendations of Kamlesh Chandra9

9. Finalize Cadre restructuring proposals of left out Categories of Department of Post.

10. Implement 5 (Five) Days Week in all Post Offices and RMS Offices.

Friday, 23 October 2020

DRAFT STRIKE NOTICE TO BE SERVED ON 27.10.2020

No.PF-12-C/2020 Dated: 27th October—2020

To

The Secretary / Director General,

Department of Posts,

Dak Bhawan,

New Delhi – 110001

NOTICE

Sir,

In accordance with the provisions of Sub Section (1) of section 22 of the Industrial Disputes Act, 1947, we hereby notify that all Postal, RMS & GDS Employees will go on One Day Strike on 26th November-2020.

The Charter of Demands is enclosed herewith

Yours Sincerely

CHARTER OF DEMANDS PART-A

1. Scrap New Contributory Pension Scheme (NPS). Restore old defined benefit Pension Scheme (OPS) to all employees. Guarantee 50% of the last pay drawn as minimum pension.

2. (a) Scrap the draconian FR 56((j) & (i) and Rule 48 of CCS (Pension) Rules 1972. Stop terrorizing and victimising employees.

(b) Withdraw the attack against the recognised status of Associations and Federations.

(c) Withdraw the anti-worker Wage/Labour codes and other anti-labour reforms.

(d) Stop attack on trade union rights.

3. (a) Withdraw the orders freezing the DA and DR of employees and Pensioners and impounding of arrears till 30-06-2021.

(b) Implement five year wage revision and Pension revision to Central Government employees and Pensioners. Appoint 8th Central Pay Commission and revise the Pay, Allowances and Pensionary benefits of Central Government employees and Pensioners with effect from 01-01-2021.

(c) Honour the assurance given by Group of Ministers (GoM) to NJCA leaders on 30-06-2016. Increase minimum pay and fitment formula recommended by 7th CPC. Grant HRA arrears from 01-01-2016.

(d) Withdraw “Very Good” bench mark for MACP, grant promotional heirarchy and date of effect of MACP from 01-01-2006.

(e) Grant Option-1 parity recommended by 7th CPC to all Central Govt. Pensioners. Grant one notional increment to those who retired on 30th June.

(f) Settle all anomalies arising out of 7th CPC implementation.

4. Stop ban on creation of new posts. Fill up all seven lakhs vacant posts in Central Government departments in a time bound manner. Scrap National Recruitment Agency and introduce Departmentwise recruitment and Regional recruitment for Group B and C posts. Stop re-engaging retired personnel in Central Govt. services.

5. Stop Corporatisation and privatisation of Railways, Defence and Postal Departments. Withdraw closure/merger orders of Govt. of India Printing Presses and Postal Stores depots/Postal Stamp depots. Stop proposed move to close down salt department. Stop outsourcing and closure of Govt. establishments.s

6. (a) Regularisation of Gramin Dak Sevaks and grant of Civil Servants status. Implement remaining positive recommendations of Kamalesh Chandra Committee Report.

(b) Regularise all casual and contract workers including those joined service on or after 01-09-1993.

7. Settle all Covid-9 related issues pertaining to Central Govt. employees and Pensioners on top priority basis. Treat the period of absence during lock down as duty. Grant full wages to casual, part-time, contingent and contract workers during the lock down period.

8. Grant equal pay for equal work for all. Remove disparity in pay scales between Central Secretariat staff and similarly placed staff working in field units of various departments.

9. Implement 7th CPC wage revision and pension revision to remaining Autonomous body employees and pensioners. Ensure payment of full arrears without further delay. Grant Bonus to Autonomous body employees pending from 2016-17 onwards

10. Remove arbitrary 5% ceiling imposed on compassionate appointments. Grant appointment in all eligible cases.

11. Grant five time-bound promotions to all Group B & C employees. Complete cadre review in all departments in a time bound manner.

12. Ensure prompt functioning of various negotiating forums under the JCM Scheme at all levels.

CHARTER OF DEMANDS PART-B

1. (a) Grant of Special Casual Leave to all the employees who could not attend due to Covid-19 related problems and issue of Uniform Guide Lines

(b) Grant of Compensation of Rs. 10 Lakh to the family of deceased due to Covid-19 without any further delay.

(c) Compassionate appointment to one ward of the deceased employee due to Covid-19.

(d) Payment of wages to Casual/Part-time /Contingent /DRM & Out sourced Workers for the Lockdown period.

(e) Continuance of Roaster till Covid-19 Problem persists.

2. Stop Closure / Merger of PSDs/ CSDs/Post Offices/RMS Offices and Mail Motor Services. Stop Road Transport Network proposal.

3. Drop the idea of Decentralization of Postal Accounts offices and merger of Circle office and SBCO Cadre in PA Cadre.

4. Stop harassment and allotment of unscientific targets to open IPPB accounts and Aadhar Enabled Payment Service and Aadhar Card Service.

5. Stop Proposal of Common Service Centres in POs.

6. Fill up all vacant posts in all Cadres and stop Recruitment of Outsourced Postal Agents particularly to run the Parcel Hubs in Department of Posts.

7. Start Membership Verification for Regular and GDS Employees through Old Check-Off System, droop the idea of Online Verification.

8. Implement remaining positive recommendations of Kamlesh Chandra9

9. Finalize Cadre restructuring proposals of left out Categories of Department of Post.